(July-17-2023)

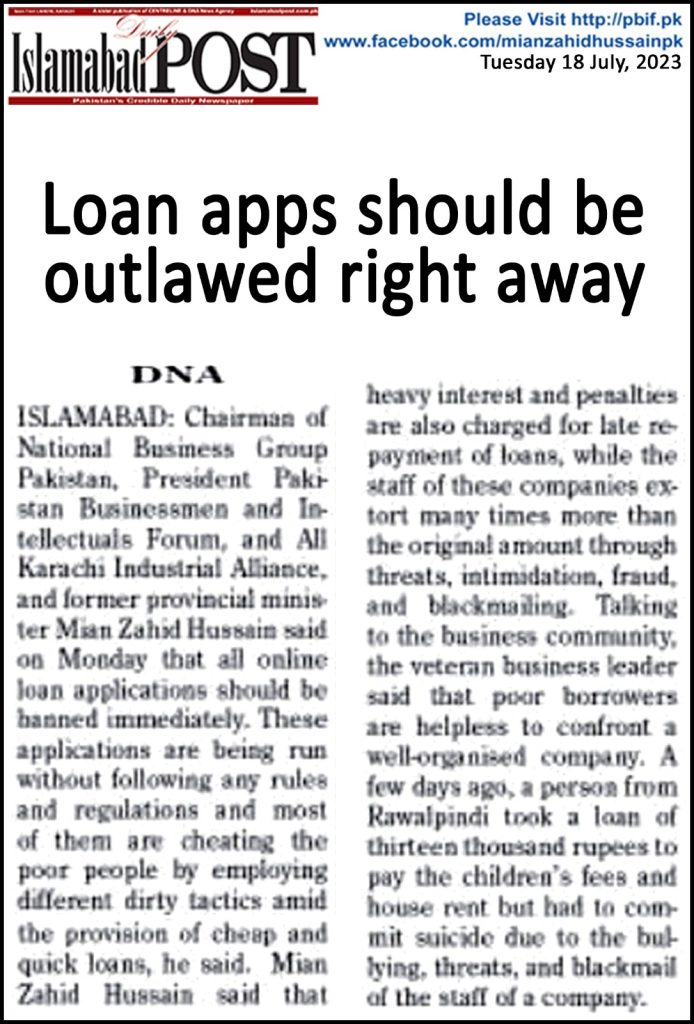

Chairman of National Business Group Pakistan, President Pakistan Businessmen and Intellectuals Forum, and All Karachi Industrial Alliance, and former provincial minister Mian Zahid Hussain said on Monday that all online loan applications should be banned immediately.

These applications are being run without following any rules and regulations and most of them are cheating the poor people by employing different dirty tactics amid the provision of cheap and quick loans, he said.

Mian Zahid Hussain said that heavy interest and penalties are also charged for late repayment of loans, while the staff of these companies extort many times more than the original amount through threats, intimidation, fraud, and blackmailing.

Talking to the business community, the veteran business leader said that poor borrowers are helpless to confront a well-organised company.

A few days ago, a person from Rawalpindi took a loan of thirteen thousand rupees to pay the children’s fees and house rent but had to commit suicide due to the bullying, threats, and blackmail of the staff of a company.

Mian Zahid Hussain said that due to the increased inflation, poverty and unemployment, many people are not able to meet the necessary expenses, so they take quick loans with the help of these applications. Despite paying the loan within the deadline, they get stuck with endless demands from the company.

In the presence of institutions like the State Bank, FIA, PTA, c, and Competition Commission in the country, this exploitative business is flourishing that can be a result of tolerance, collusion, and incompetence.

The business leader said that after numerous complaints and the suicide of a person, the FIA has raided some offices involved in loan sharking, which will not stop this business; therefore, the government should root out this business that thrives on exploiting the masses.

Last year, the Securities and Exchange Commission said online lenders were barred from tougher recovery measures, but this was limited to the company’s statement, while the Competition Commission urged the public to be cautious when dealing with such lenders.

After making these two statements, both organisations believed that their responsibility was over and that the public was left at the mercy of the online loan sharks.

Mian Zahid Hussain further said that apart from online companies, other people across the length and breadth of the country are also doing the nefarious business of giving loans at high-interest rates on unfair terms. May are selling goods in installments and robbing the poor with both hands, for which legislation is needed.

He demanded that the government can make it easy for people to take small loans so that illegal businesses could not thrive.

Self-employment schemes should also be introduced, and small loans should be on easy terms for rickshaw pullers, vegetable vendors, bakers, plumbers, carpenters, etc.