(August-02-2023)

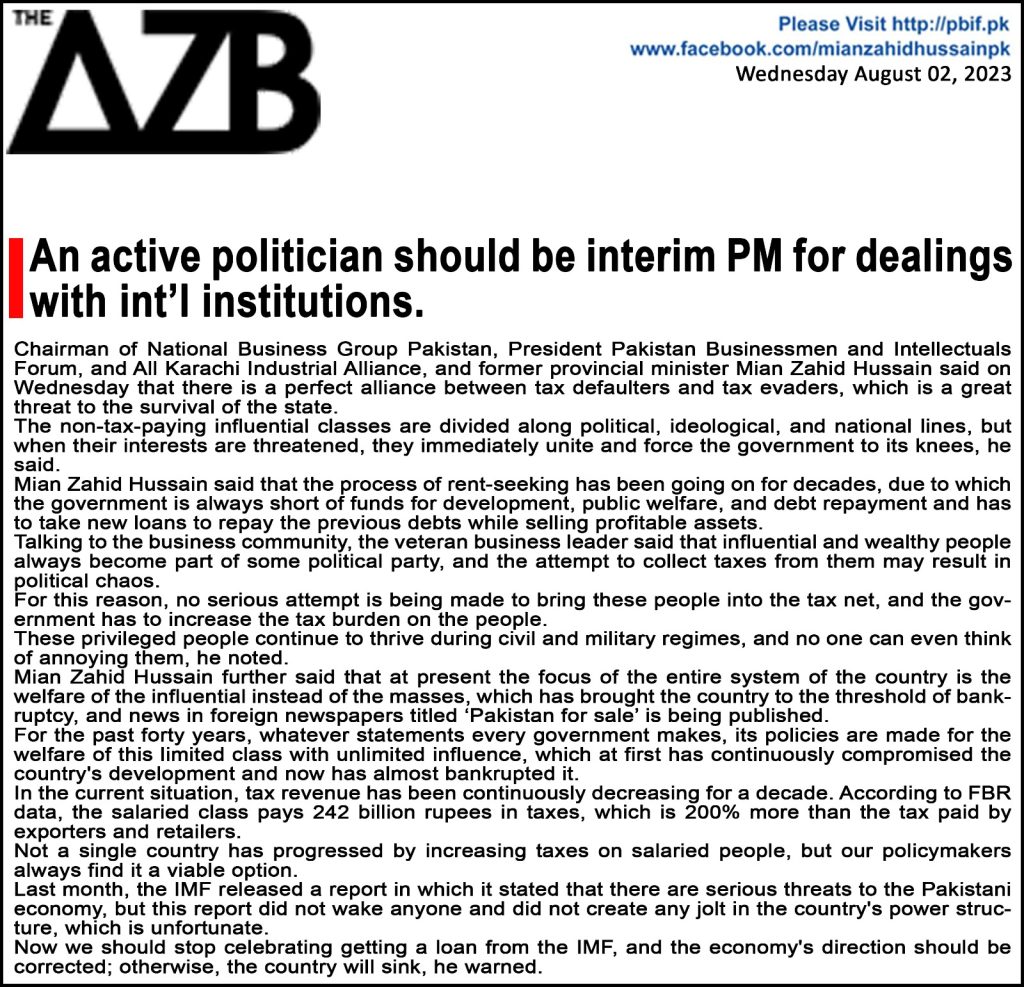

Chairman of National Business Group Pakistan, President Pakistan Businessmen and Intellectuals Forum, and All Karachi Industrial Alliance, and former provincial minister Mian Zahid Hussain said on Wednesday that there is a perfect alliance between tax defaulters and tax evaders, which is a great threat to the survival of the state.

The non-tax-paying influential classes are divided along political, ideological, and national lines, but when their interests are threatened, they immediately unite and force the government to its knees, he said.

Mian Zahid Hussain said that the process of rent-seeking has been going on for decades, due to which the government is always short of funds for development, public welfare, and debt repayment and has to take new loans to repay the previous debts while selling profitable assets.

Talking to the business community, the veteran business leader said that influential and wealthy people always become part of some political party, and the attempt to collect taxes from them may result in political chaos.

For this reason, no serious attempt is being made to bring these people into the tax net, and the government has to increase the tax burden on the people.

These privileged people continue to thrive during civil and military regimes, and no one can even think of annoying them, he noted.

Mian Zahid Hussain further said that at present the focus of the entire system of the country is the welfare of the influential instead of the masses, which has brought the country to the threshold of bankruptcy, and news in foreign newspapers titled ‘Pakistan for sale’ is being published.

For the past forty years, whatever statements every government makes, its policies are made for the welfare of this limited class with unlimited influence, which at first has continuously compromised the country’s development and now has almost bankrupted it.

In the current situation, tax revenue has been continuously decreasing for a decade. According to FBR data, the salaried class pays 242 billion rupees in taxes, which is 200% more than the tax paid by exporters and retailers.

Not a single country has progressed by increasing taxes on salaried people, but our policymakers always find it a viable option.

Last month, the IMF released a report in which it stated that there are serious threats to the Pakistani economy, but this report did not wake anyone and did not create any jolt in the country’s power structure, which is unfortunate.

Now we should stop celebrating getting a loan from the IMF, and the economy’s direction should be corrected; otherwise, the country will sink, he warned.